Involves a firm pooling capital from qualified investors (high-income and institutional)

to invest collectively in commercial real-estate.

1

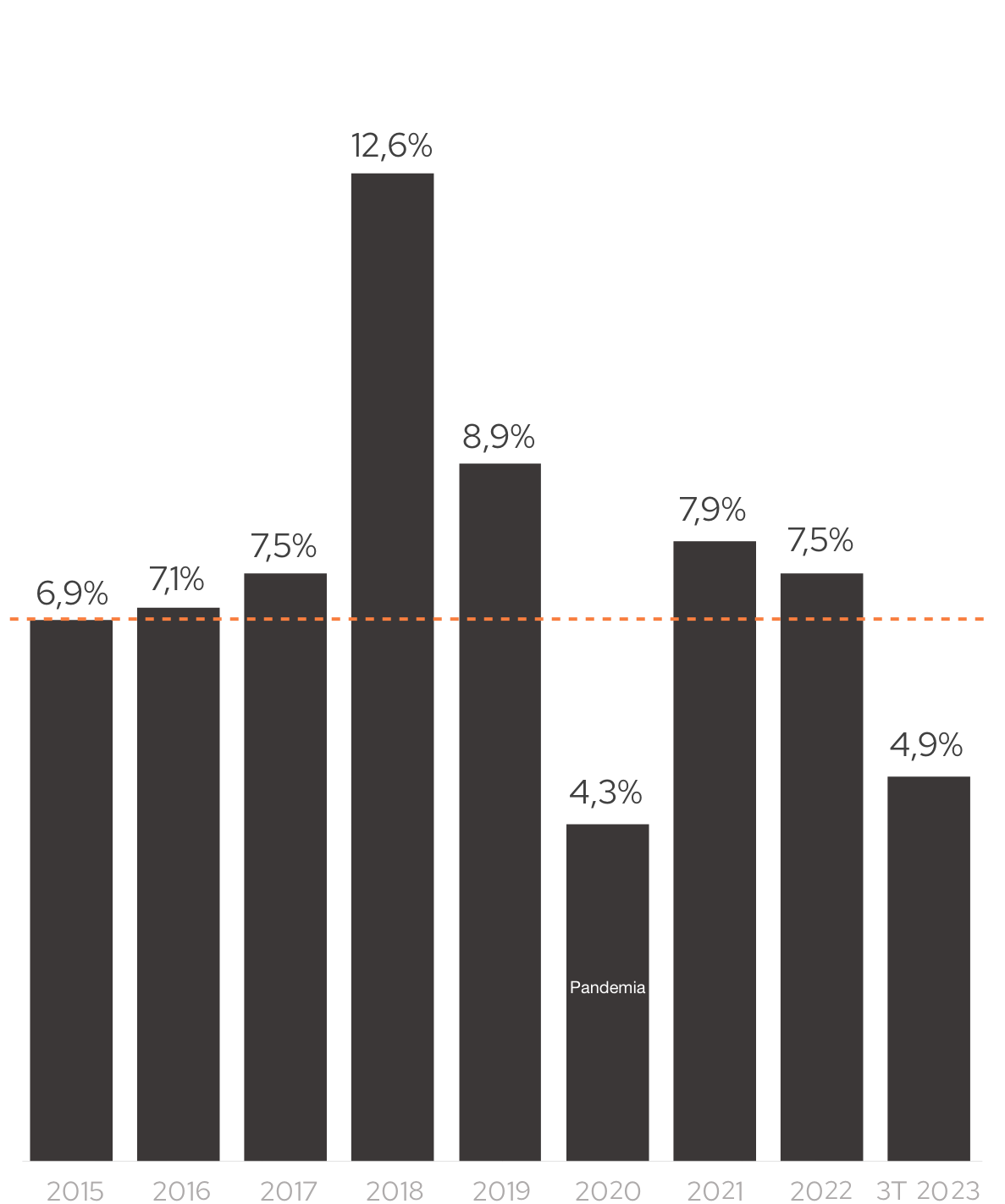

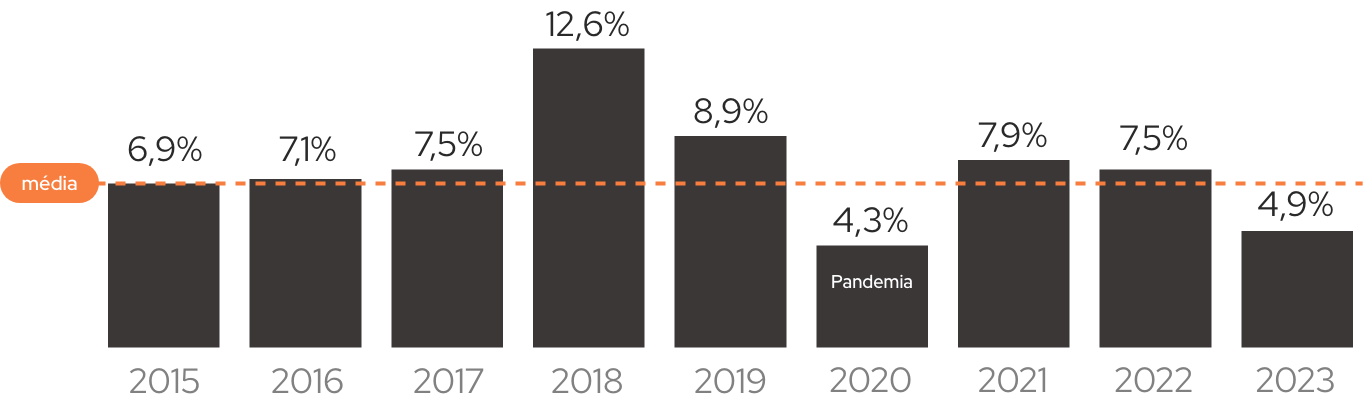

STRONG HISTORICAL RETURNS

There is strong evidence that private real estate outperforms stock markets and bonds in the long term, adjusted for risk.

2

LOW VOLATILITY

Private real estate inherently demonstrates reduced volatility and a limited correlation with both stocks and bonds, offering a favorable risk profile.

3

CONSISTENT CASH FLOW

Many private real estate investments will target regular cash flow, often paying monthly or quarterly distributions

1

STRONG HISTORICAL RETURNS

There is strong evidence that private real estate outperforms stock markets and bonds in the long term, adjusted for risk.

2

LOW VOLATILITY

Reduced volatility and low correlation with

the financial markets.

3

CONSISTENT CASH FLOW

Many private real estate investments will target regular cash flow, often paying monthly or quarterly distributions

4

performance

historical

When wisely invested, real estate can be passed down from one generation to the next.

5

HEDGE AGAINST INFLATION

Commercial real estate has historically increased or maintained its value and overall performance during inflationary periods.

6

TAX BENEFITS

The tax framework for this class of assets in the US is extremely attractive for investors.

4

PERFORMANCE

HISTORICAL

GENERATIONAL ASSETS

When wisely invested, real estate can be passed down from one generation to the next.

5

HEDGE AGAINST INFLATION

Commercial real estate has historically increased or maintained its value and overall performance during inflationary periods.

6

TAX BENEFITS

The tax benefits of real estate investing in the US can be significant and impactful.

We are a real-estate investment firm specialized in the US markets, with more than 10 years of experience. Having invested in more than 30 states, we leverage our profound expertise in the US real estate market, vast networks, advanced analytical tools, and robust risk management protocols to offer our clients unparalleled investment opportunities.

We are a US Real Estate Private Equity investment consultancy (Club Deals) with over 10 years of experience. Having invested in over 30 states, we combine in-depth knowledge of the US real estate market, an extensive network of contacts, sophisticated analysis tools and robust risk management processes to bring our clients exceptional investment opportunities.

Established in 2012 to cater to the needs of affluent individuals and institutional investors seeking good alternative investment opportunities, we are a global conglomerate comprising Ativore Investments, a tax consultancy, and an asset management firm.

Ativore Global Investments is founded

Shield International Tax is founded

Ativore Asset Management is founded

Launching of the 1st Offshore “Value Add” Master Fund

Launching of the 1st “Value Add” Feeder Fund

Internationalization of Ativore Group

Launching of the 2nd International “Build-to-Rent” Fund

Ativore Global Investments is founded

Shield International Tax is founded

Ativore Asset Management is founded

Launching of the 1st Offshore “Value Add” Master Fund

Launching of the 1st “Value Add” Feeder Fund

Internationalization of Ativore Group

Launching of the 2nd International “Build-to-Rent” Fund

We uphold unwavering standards of integrity, demanding nothing less than the utmost commitment from our employees and partners. These principles are deeply ingrained in every facet of our operations, guiding our processes and policies without compromise.

We foster an environment that inspires our team to push their boundaries and unlock their fullest potential each day. Those who succeed not only experience personal growth but also evolve alongside us.

We endeavor to be honest with our clients. We operate autonomously, solely compensated by our clients, and are free to pursue strategies that we deem most beneficial in generating maximum value for them.

We whole-heartedly believe in our strategies. All our founding partners invest in Ativore products.

Our mission is to be a global reference in US real estate private equity.

We uphold unwavering standards of integrity, demanding nothing less than the utmost commitment from our employees and partners. These principles are deeply ingrained in every facet of our operations, guiding our processes and policies without compromise.

We foster an environment that inspires our team to push their boundaries and unlock their fullest potential each day. Those who succeed not only experience personal growth but also evolve alongside us.

We endeavor to be honest with our clients. We operate autonomously, solely compensated by our clients, and are free to pursue strategies that we deem most beneficial in generating maximum value for them.

We whole-heartedly believe in our strategies. All our founding partners invest in Ativore products.

Our mission is to be a global reference in US real estate private equity.

We uphold unwavering standards of integrity, demanding nothing less than the utmost commitment from our employees and partners. These principles are deeply ingrained in every facet of our operations, guiding our processes and policies without compromise.

We foster an environment that inspires our team to push their boundaries and unlock their fullest potential each day. Those who succeed not only experience personal growth but also evolve alongside us.

We endeavor to be honest with our clients. We operate autonomously, solely compensated by our clients, and are free to pursue strategies that we deem most beneficial in generating maximum value for them.

We whole-heartedly believe in our strategies. All our founding partners invest in Ativore products.

Average Dividends

Realized IRR

Realized IRR

Average Dividends

Founding year

Accredited US operators

Asset classes

US states

Approved investments

* The above statement reflects the investments of clients advised by Ativore Investments since the inception of the company. Past performance is not indicative of future results. It considers only the cash distributed to investors on the total invested amount, including operational results and realized capital gains from asset sales. It does not account for mark-to-market adjustments to portfolios. In the event of mark-to-market adjustments, the results could vary

A multifamily residential complex located in Arvada, Colorado.

Acquisition (2019)

USD 18.7MM

Sale (2023)

USD 26.9MM

% of Appreciation

43.6%

Internal Rate of Return (IRR)

47% p.a.

Annual Average Dividends

8% p.a.

Self-storage units located in the Southeast of the US.

Acquisition (2017)

USD 23MM

Sale (2022)

USD 40MM

% of Appreciation

73.6%

Internal Rate of Return (IRR)

24.3% p.a.

Annual Average Dividends

7.9% p.a.

A Class A operational office complex in San Francisco, CA.

Acquisition (2020)

USD 134MM

Sale (2022)

USD 182MM

% of Appreciation

35.9%

Internal Rate of Return (IRR)

25.9% p.a.

Annual Average Dividends

7.2% p.a.

A multifamily residential complex located in Haverhill, MA.

Acquisition (2020)

USD 29MM

Sale (2022)

USD 40MM

% of Appreciation

37.9%

Internal Rate of Return (IRR)

34.4% p.a.

Annual Average Dividends

6.2% p.a.

- Founder of Ativore Global and over 25 years of experience in international real estate investments

- Structured real estate investments in over 30 states in the US since 2012

- 20 years as Partner/ CEO and/or Consultant at Arthur Andersen, Deloitte and KPMG in 4 countries

- Led M&A projects and relevant nationwide projects in the financial sector

- Founder of Ativore Asset with 30 years of experience in the international financial market

- CEO of IBT Asset Management, CEO of Itaú Corretora de Valores and Head of Equities

- Led the international expansion of Itau Asset Management

- Board member of Harvard Business School Alumni Angels Brasil since 2016

- Founder of Ativore Global and executive responsible for the management of the company's investments

- Structured real estate investments in over 30 states in the US since 2012

- Led the assembly of real estate portfolios of over R$ 600 million for investors in 8 countries

- Previously worked in consulting firms such as IBM and Elogroup

- Founding partner and member of the Board of Directors of the Ativore Group.

- Founding partner and director of EloGroup, a full-service consulting company in Brazil that integrates technology, analysis and management to drive the digital transformation of businesses, with more than 500 employees.

- He holds a master's degree in Production Engineering from UFRJ

• Independent Risk Committee Member at Ativore Group

• Over 35 years of experience in Auditing and Consulting to Financial Institutions

• Former Managing Partner at Deloitte Brazil, where he was a member of the Policy Committee (Board of Directors) and Leader of the Financial Services Industry.

• Prior experience included the position of Managing Partner at Arthur Andersen and Chase Manhattan Bank.

- CFO and partner at Ativore Global Investments, responsible for financial management and implementation of strategic projects

- 10 years of experience in structuring small and medium enterprises, problem solving and development of new technologies and products

- Co-Founder of the startup Beep Saúde, largest home vaccine company in South America

- Operations Director and Partner at Ativore Global Investments, responsible for all the manager's operations and leader of the compliance area.

- She was responsible for developing the real estate investment analysis models of Value Drivers, Benchmarking, Sensitivity, Stress Testing and Structuring for Ativore's investment funds.

- She has a degree in Economics and a master's degree in Finance, both from the University of São Paulo (USP).

- Partner responsible for the relationship with +140 families of portfolios whose sum exceeds R$1.5 billion in Fiscal Management and R$800 million in real estate assets

- Led the implementation of hundreds of international structuring, involving countries such as USA and BVI and investment acquisitions in several American States

- A graduate of the Federal University of the State of Rio de Janeiro, UNIRIO with previous experience in the consulting area through the companies Elogroup and Yolo Experience

- Partner responsible for the Institutional Investors area with more than 15 years of experience in the financial market

- Over the years, she has worked in several Asset Management areas, including Management, Products, Commercial and Investor Relations in institutions such as Credit Suisse, Banco Votorantim and Banco Bradesco

- Since 2013 works in the universe of alternative investments, with experience in Private Equity, Real Estate and Debt

- Partner in the Investor Relations area with more than 8 years of experience with customer service

- Certified professional

by Anbima

- 6 years of experience in

financial market

- Partner in charge of research and analysis of real estate investment opportunities in the USA

- Held leadership positions in consulting and real estate development companies in the area of investment appraisal

- Holds a master's degree in Real Estate Finance from the University of Amsterdam and a Full-time MBA from Coppead-UFRJ. He holds a BA in Economics from UFRJ

- At Ativore since 2018, he is the partner responsible for the areas of prospecting for new investment opportunities and monitoring invested assets

- He was co-responsible for structuring the processes and analysis methodologies for real estate investments at Ativore

- He has a degree in economics from the Federal University of Rio de Janeiro, with part of his undergraduate studies at King's College London in England. Currently, he is a member of the Chartered Financial Analyst (CFA) certification program.

São Paulo

Gomes de Carvalho Street, 1195, Unit 61

Zip Code 04547-004 - Vila Olímpia, São Paulo, Brazil.

Miami

1221 Brickell Ave Suite 900, Miami

FL 33131, United States.

Legal Notice: Ativore Investimentos Privados LTDA ("Ativore") is a consulting company, which also acts as the operator of the website www.ativore.com. By accessing the website and any of its pages, you agree to be bound by its Terms of Service and Privacy Policy. The Ativore website may contain links to external websites and external websites may contain links to the Ativore website. Ativore is not responsible for the content or operation of any such external websites, does not approve or endorse the content of these websites and disclaims any liability whatsoever in connection with the content or operation of any such external websites. Ativore does not make investment recommendations and does not issue Legal Opinions, and no communication through this website or any other means should be construed as such. The services provided by Ativore are a consultancy based on its experience in several projects of different complexities and methodologies developed internally for the analysis of real estate investments in the USA, as well as equity, tax and succession assessments, applicable to international investors. The information contained on Ativore's website is for information purposes only and is based on public information, internally developed studies and other external sources. Ativore does not represent or warrant that the information contained on this website will be applicable to all users of the site. All accredited users using the www.ativore.com website must recognize and accept the high risks associated with any type of investment, including those described on our website. Ativore does not provide final analysis or recommendations on any content presented on the website. No person should act or refrain from acting on the basis of any content on the Ativore website without first obtaining expert advice. All investors must make their own decisions as to whether or not to make any investment, based on their own independent assessment and analysis. Nothing on Ativore's websites should be considered as an advisor-client relationship or even any contractual relationship or as providing financial, accounting, legal or professional advice on any specific matter. It is recommended that any interested parties consult their technical, legal, financial, accounting or business advisors and carry out their own independent analysis before making any final investment or tax and succession structuring decisions. Any financial or market projections eventually presented on the website are merely forecasts (estimated in good faith on the basis of available data), and are hypothetical and not based on actual investment results, so they are not guarantees of future results. Such projections do not represent or guarantee the results of any transaction, and there is no guarantee that any transaction will or may achieve results or profits similar to those shown. Any information contained herein has been obtained from sources that Ativore believes to be reliable, but we make no representations or warranties as to the accuracy of such information and assume no liability in respect thereof. Neither Ativore nor any of its partners, directors, officers, employees, representatives, affiliates or agents shall have any liability for any error or misstatement of fact or opinion in, or failure to exercise reasonable care in the preparation or publication of, the materials and communications contained herein, nor for any damages, direct or indirect, arising out of actions or decisions taken in reliance on the information contained on Ativore's website.

Access our social media

Fill in with your data and receive exclusive content about

Real Estate Investments in the USA with strong Dollar Income Generation

Receive content created by our team of specialists