The sale of the NNN - Silicon Valley Office Building, located in San Francisco (CA), with investments from Ativore clients, generated an annualized Internal Rate of Return (IRR), in dollars, of 25.9%, which was higher than the originally forecast 10%, and an Equity Multiple of 1.6x.

Since its acquisition, in 2020, for US$ 134 million, GMF Capital successfully improved the asset management, optimized by the excellent location of the property, resulting in annual average dividends of 7.2% over the course of the project and a sale at US$ 183 million, meaning an appreciation of 36%, taking advantage of the exceptional moment in the market conditions.

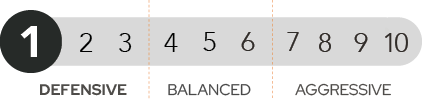

*Less sensitivity to economic cycles accepting lower profitability.

A multifamily residential complex located in Haverhill, MA.

Acquisition (2020)

USD 29MM

Sale (2022)

USD 40MM

% of Appreciation

37.9%

Internal Rate of Return (IRR)

34.4% p.a.

Annual Average Dividends

6.2% p.a.

Self-storage units located in the Southeast of the US.

Acquisition (2017)

USD 23MM

Sale (2022)

USD 40MM

% of Appreciation

73.6%

Internal Rate of Return (IRR)

24.3% p.a.

Annual Average Dividends

7.9% p.a.

A multifamily residential complex located in Arvada, Colorado.

Acquisition (2019)

USD 18.7MM

Sale (2023)

USD 26.9MM

% of Appreciation

43.6%

Internal Rate of Return (IRR)

47% p.a.

Annual Average Dividends

8% p.a.

contact us

São Paulo

Gomes de Carvalho Street, 1195, Unit 61

Zip Code 04547-004 - Vila Olímpia, São Paulo, Brazil.

Join our team

Access our social media

Visit our social networks