To achieve solid risk-adjusted returns in dollars, generating cash flow for investors through a U.S. based private equity real estate investment portfolio.

November 2020

US$ 250,000

7 to 10 years

Fund is closed

IRR of 10% to 12% p.a. Dividends of 5% to 7% p.a.

1.5% p.a.

20% after 7% p.a. IRR

November 2020

US$ 250,000

7 to 10 years

Fund is closed

IRR of 10% to 12% p.a. Dividends of 5% to 7% p.a.

1.5% p.a.

20% after 7% p.a. IRR

1 Return projections are estimated and may not materialize.

2 Expected return represents the consolidated estimated returns of all the assets acquired by the fund.

U.S. based private equity real estate investment portfolio, generating solid risk-adjusted returns in US dollars.

Investment with experienced local partners, specialized by region and property type.

A strategy based on creating value through property upgrades.

A focus on the secondary and tertiary US markets, with strong pro-business economic and political foundations.

Acquisitions of up to $100 million.

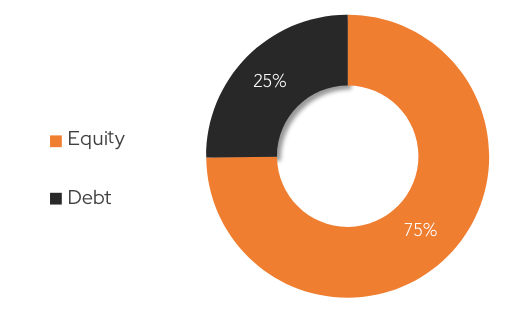

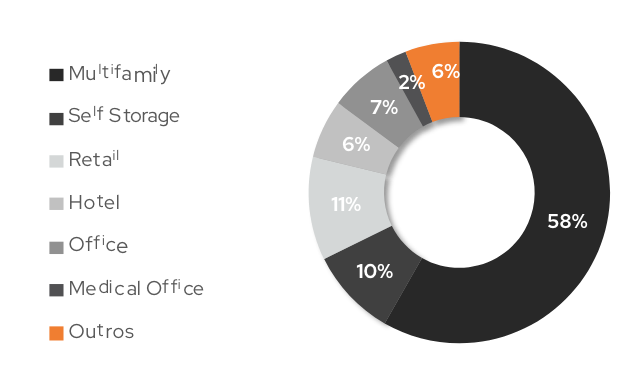

By region, type of property, risk profile and type of investment (private equity or debt).

Investors

Cayman Fund

US Blocker

Real Estate Assets

Multifamily | Equity

Multifamily residential complex.

Location

Naples, FL

Acquisition

12/2020

Projected IRR1

15.1% p.a.

Average Dividends2

10.2% p.a.

Self Storage | Equity

Warehouses and self-storage

Location

Different regions, USA

Acquisition

12/2020

Projected IRR1

15% p.a.

Average Dividends2

7.8% p.a.

Multifamily | Debt

Multifamily residential complex.

Location

West Coast, USA

Acquisition

12/2020

Projected IRR1

11% p.a.

Average Dividends2

10% p.a.

Multifamily | Debt

Multifamily residential complex.

Location

Different regions, USA

Acquisition

12/2020

Projected IRR1

13.5% p.a.

Average Dividends2

10% p.a.

Diversified | Debt

Senior real estate loans.

Location

Different regions, USA

Acquisition

12/2020

Projected IRR1

11% p.a.

Average Dividends2

11% p.a.

Office | Equity

Commercial office complex.

Location

Philadelphia, PA

Acquisition

03/2021

Projected IRR1

13.5% p.a.

Average Dividends2

10% p.a.

Multifamily | Equity

Multifamily residential complex.

Location

Fort Worth, Dallas

Acquisition

03/2021

Projected IRR1

14.7% p.a.

Average Dividends2

10.8% p.a.

Multifamily | Equity

Multifamily residential complex.

Location

Sun Belt, USA

Acquisition

03/2021

Projected IRR1

12.3% p.a.

Average Dividends2

7.1% p.a.

Diversified | Diversified

Real-estate fund diversified between equity and debt investments.

Location

Sun Belt, USA

Acquisition

04/2021

Projected IRR1

13.8% p.a.

Average Dividends2

8% p.a.

Medical Office | Equity

Medical office complex.

Location

Princeton, NY

Acquisition

04/2021

Projected IRR1

15.7% p.a.

Average Dividends2

8.3% p.a.

Retail | Equity

Operational properties fund.

Location

Sun Belt, USA

Acquisition

04/2021

Projected IRR1

15.6% p.a.

Average Dividends2

12.4% p.a.

Multifamily | Equity

Multifamily residential complex.

Location

Columbus, OH

Acquisition

06/2021

Projected IRR1

15.2% p.a.

Average Dividends2

9.8% p.a.

Multifamily | Equity

Multifamily residential complex.

Location

Redlands, LA

Acquisition

06/2021

Projected IRR1

15.8% p.a.

Average Dividends2

9.3% p.a.

Self Storage | Equity

Warehouses and self-storage

Location

Different regions, USA

Acquisition

10/2021

Projected IRR1

13.9% p.a.

Average Dividends2

8% p.a.

Multifamily | Equity

Multifamily residential complex.

Location

Doral, FL

Acquisition

12/2021

Projected IRR1

18.4% p.a.

Average Dividends2

8.7% p.a.

Hotel | Equity

Boutique Hotel.

Location

Miami Beach, FL

Acquisition

02/2022

Projected IRR1

15.1% p.a.

Average Dividends2

7.7% p.a.

Office | Equity

Commercial office complex.

Location

Andover, MA

Acquisition

09/2022

Projected IRR1

17.5% p.a.

Average Dividends2

10.8% p.a.

Retail | Equity

Commercial properties complex.

Location

San Diego, CA

Acquisition

08/2022

Projected IRR1

14.7% p.a.

Average Dividends2

7.4% p.a.

Multifamily | Equity

Multifamily residential complex.

Location

Cohoes, NY

Acquisition

10/2022

Projected IRR1

14.5% p.a.

Average Dividends2

8.8% p.a.

1. Profitability forecasts are estimates and may not materialize. 2. Average dividends: dividends may vary from year to year.

São Paulo

Gomes de Carvalho Street, 1195, Unit 61

Zip Code 04547-004 - Vila Olímpia, São Paulo, Brazil.

Miami

1221 Brickell Ave Suite 900, Miami

FL 33131, United States.

The information contained on this website is for information purposes only and does not constitute investment advice of any kind andshould not be used for that purpose. Investors should not rely onthe information contained herein without seeking the advice of a professional. No information contained on this website constitutes a solicitation, offer or recommendation to buy or sell shares in any investment fund managed by Ativore Asset or any other securities, nor may it be construed as such in any jurisdiction in which such solicitation, offer or recommendation would be unlawful or subject to specific rules. Investment funds may use derivative strategies as an integral part of their investment policy ; such strategies, if and in the manner they are adopted, may result in significant equity losses for their shareholders, and may even result in losses exceeding the capital invested and the consequent obligation of the shareholder to contribute additional resources to cover the loss of the funds. When investing their funds,investors are advised to carefully read the prospectus, the factsheet and the regulations in their entirety .Authorization by the members of the distribution system to operate and/or sell investment fund quotas and other securities does not imply, on the part of the Securities and Exchange Commission or ANBIMA , aguarantee that the information provided is true, that the respective regulations and prospectuses are in line with current legislation or, furthermore, a judgment on the quality of the funds and other securities, their administrator, manager and other service providers. Investment funds are not guaranteed by the Fundo Garantidor deCrédito (Credit Guarantee Fund).Ativore Gestora de Recursos Ltda (Ativore Asset), its managers and employees disclaim liability for any damages resulting directly or indirectly from the use of the information contained on this site.The content of this site must not be reproduced, distributed or published under any circumstances or for any purpose.

Access our social media

Fill in with your data and receive exclusive content about

Real Estate Investments in the USA with strong Dollar Income Generation

Receive content created by our team of specialists